Fraud

Prevention

Effective solution for identifying and preventing fraud

Fast changing technology, data security policies and human behaviour continuously influence fraud prevention. This means that fraud often adapts faster to changes than the prevention activities. To combat this, businesses require dynamic fraud prevention solutions.

Accurate predictive models based on historical and real-time data are a prerequisite for successfully preventing fraud. Predictive analytics supports the preventive detection and combating of fraud like credit fraud, insider trading, insurance fraud etc..

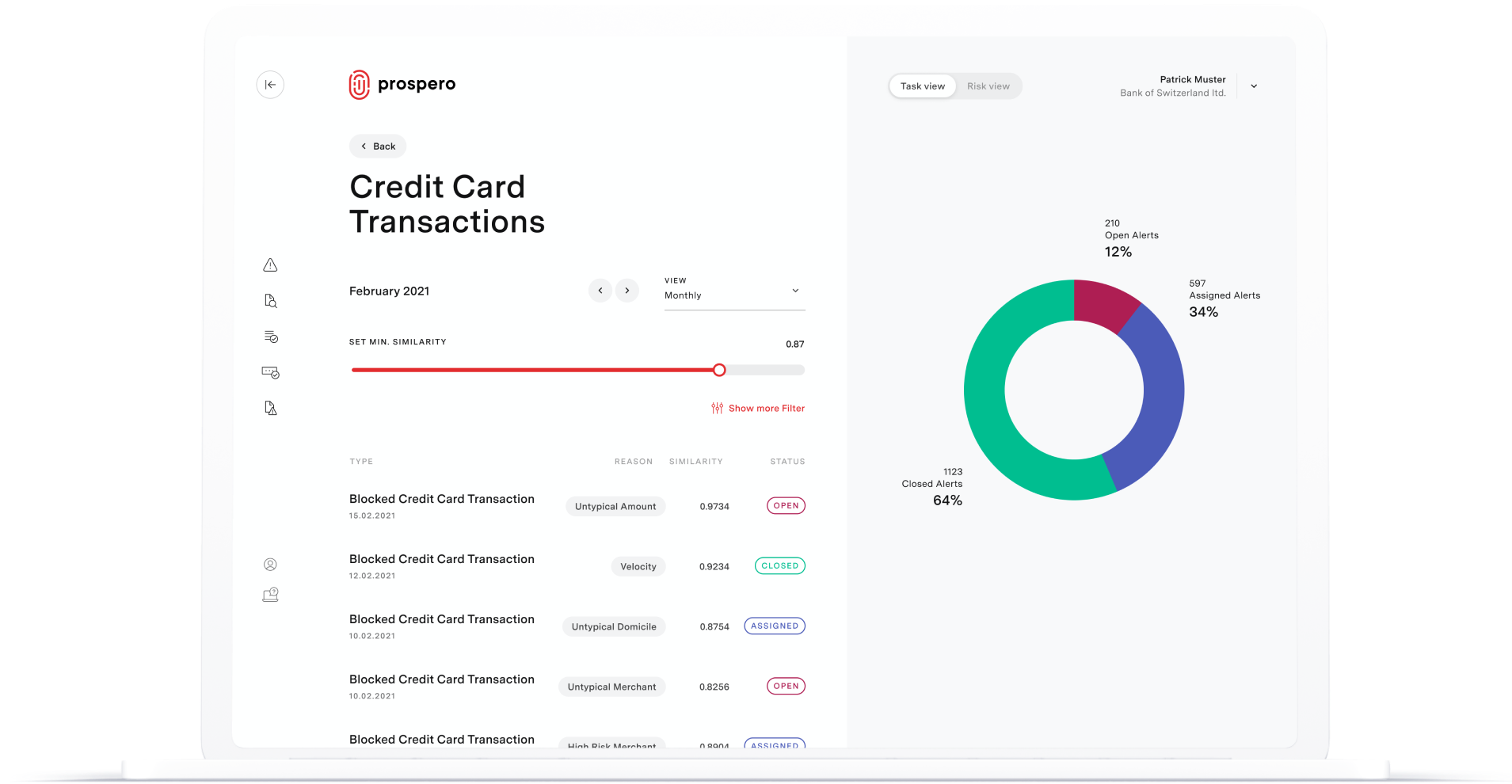

Reliable data analytics with Prospero DetectX®

The integrated management of filters and models as well as the user friendly workflow for the alert investigation provide efficient and effective work in compliance. DetectX®-FD Fraud Prevention can be easily integrated into existing environments.

The automated optimisation of filters and models allow for a continuous learning process, resulting in maximised recognition rates and minimised false detections. The recognition models adapt in real time to changed behaviour of fraudsters. The impact of new scenarios can be tested in the simulation module.

Key features of DetectX-FD

Can be applied in various processes and business scenarios

Early detection of fraud

Real-time monitoring of large amounts of data

Integrated feedback learning with in-memory analysis for ongoing improvement of recognition quality

Case Management and workflow for analysis, investigation and documentation of identified suspected fraud cases

Benefits of DetectX-FD

Maximised detection rates while minimising false detection

Reduction of fraud and losses

High process security

Minimisation of reputational risk

Regulatory requirements and compliance

The products assure compliance with numerous national and international regulatory requirements and standards.

In the area of Anti Money Laundering (AML), Fraud Detection and Prevention the products support the internationally recognised and accepted GAFI / FATF recommendations as well as the fulfilment of the regulatory requirements of the Swiss GwG, FINMA-GwV, VsB 16 and KAG on a very high-quality level.

The solutions are based on precise analytics and support the user in the fulfilment of the MiFID /EMIR requirements as well as the Swiss FinfraG, FidleG, BEHG, KAG and KKG acts, laws and regulations in the areas of risk based customer analysis, product suitability rule and exception handling, market transparency and cross border.

The products also support the qualitative and quantitative regulatory requirements in the areas of BASEL II/III, CRR and CRD IV minimal regulatory capital calculation, liquidity risk analysis (LCR / NSFR), static and dynamic stress testing and simulations, collateral optimisation and many others.

DetectX® Solutions

The DetectX® platform supports a range of powerful business solutions: